2024 M-PESA charges: Transfers, Pochi la Biashara, Till number, Pay Bill & withdrawals

)

M-PESA offers a fast, convenient, and secure method for sending and receiving money, paying bills, and even accessing loans.

However, there are transaction charges involved, these fees can vary depending on the amount being transacted and the type of service being used, such as person-to-person transfers, withdrawals, or bill payments.

Understanding the structure and impact of M-PESA transaction charges is essential for users to maximize their financial resources and make informed decisions about their transactions.

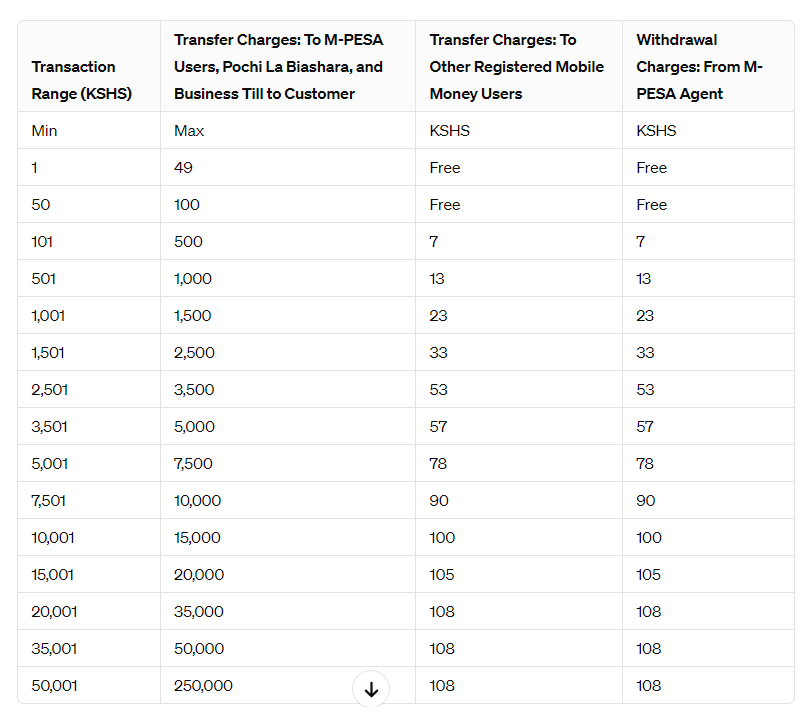

Below is a table showing the M-PESA transaction charges for 2024 for Transfers, Pochi la Biashara, Till number, Pay Bill & withdrawals.

2024 M-PESA charges: Transfers, Pochi la Biashara, Till number, Pay Bill & withdrawals

A table showing MPESA transaction charges for 2024

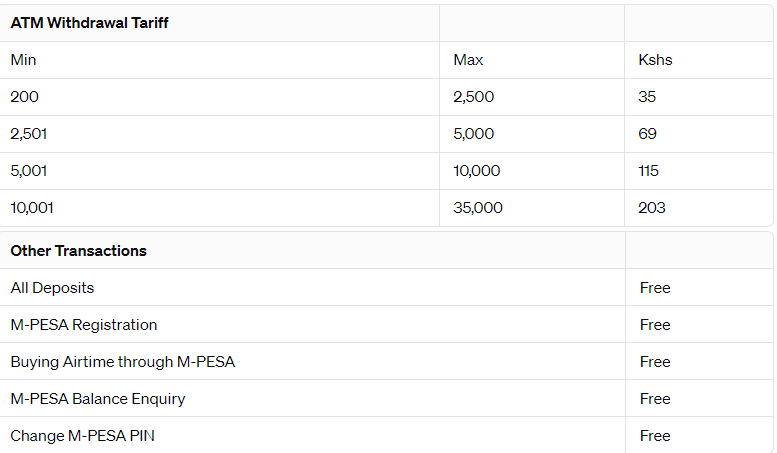

Besides mobile to mobile, there is the option for ATM withdrawals which has a different set of charges.

Some services offered on the platform such as balance inquiry also have their charges most of which are free.

ATM charges for M-PESA withdrawals 2024

To enhance the security and efficiency of its services the platform has set clear transaction limits.

The maximum account balance a user can hold at any given time is capped at Sh500,000.

To accommodate significant transactions while promoting responsible usage, M-PESA has also established a maximum daily transaction value of Sh500,000. However, users should note that for a single transaction, the limit is Sh250,000.

To make withdrawals at M-PESA agent outlets, the service stipulates that transactions cannot be less than Sh50, ensuring that agents can manage their liquidity.

Additionally, in the case of a transaction mishap, users can swiftly initiate a self-reversal by sending the transaction confirmation to 456.

M-PESA also emphasises that direct deposits into another customer’s account must be transacted digitally, as agent outlets cannot facilitate this.

Sending money to unregistered M-PESA users

Safaricom in February 2024 discontinued the sending of money to other unregistered users.

Previously, it was possible to send money to unregistered users. They would then receive a voucher message that they would use to claim their money at any M-PESA agent within 7 days.

)

)

)

)

)

)

)