Kenyans hit by 2nd round of taxes from Finance Act 2023

)

As the clock strikes September 1, the second phase of new taxes introduced by the contentious Finance Act 2023 will take effect, reverberating across several industries and sectors.

From cement and steel industries to digital assets and entertainment, the impact of these measures is set to reshape various facets of the economy.

Among the significant changes coming into play is the implementation of a 3 per cent tax on the sale of digital assets, including cryptocurrencies, content, music, ebooks, and visual creations.

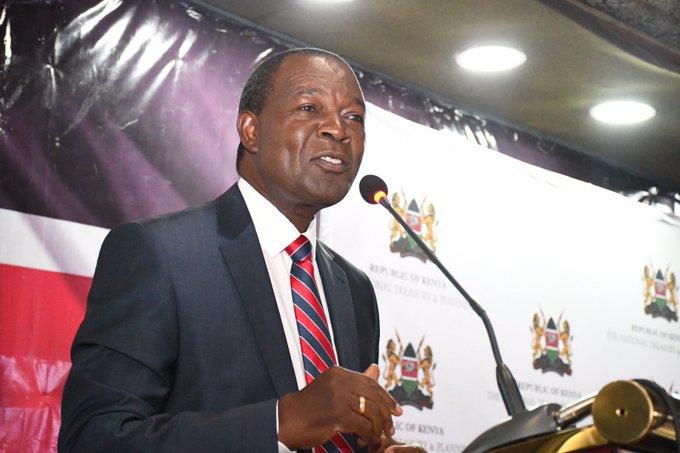

Treasury CS Njuguna Ndung'u says Kenya is undergoing significant growth in digital trade but the State is not receiving its share in the form of tax.

"Despite the multiple transactions and businesses going on in digital platforms and its advantages, the transactions are yet to reflect on the tax net," CS Njunguna says.

Additionally, the cost landscape in industries such as construction and manufacturing will witness shifts.

The manufacture of cement will bear the brunt of a 17.5 per cent Export and Investment Promotion Levy on imported clinker, a raw material crucial to production.

Finished iron and steel will also face the same levy, impacting the cost of construction. Imported paper, sacks, and bags will incur a 10 per cent export levy, affecting supply chains and pricing.

However, the introduction of electronic tax systems marks a milestone with far-reaching implications. The Kenya Revenue Authority (KRA) gains enhanced visibility into transactions and company stock levels, streamlining tax compliance.

The electronic tax invoice system (eTIMS) mandates the issuance of electronic invoices and the maintenance of stock records to ensure adherence to tax regulations.

A noteworthy aspect of this change is the escalation of penalties for non-compliance. Businesses failing to adopt eTIMS could face fines of twice the tax value due, a substantial increase from the existing penalty of Sh100K.

The Kenya Revenue Authority will be expanding its tax net by leveraging on technology, to seal any tax gaps leading to revenue losses.

KRA Commissioner General Humphrey Mulongo, says Kenya may finally hit the 3 trillion shilling tax mark in the next financial year, with the enactment of the national tax policy.

)

)

)

)

)

)

)

)